Portuguese Vat Number Example . The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Portuguese vat number format individuals: 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. The taxpayer individual number (”número de identificação fiscal” (nif)) is. Taxable persons that have their business, a fixed establishment,. For individuals, entities, vat, example: Vat is paid by consumers when paying for goods or services. Supplies of services are subject to vat in portugal if provided to: Value added tax (vat) is a tax levied on sales or supplies of services in portugal.

from xneelo.co.za

Supplies of services are subject to vat in portugal if provided to: Taxable persons that have their business, a fixed establishment,. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Portuguese vat number format individuals: The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. The taxpayer individual number (”número de identificação fiscal” (nif)) is. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. For individuals, entities, vat, example: 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Vat is paid by consumers when paying for goods or services.

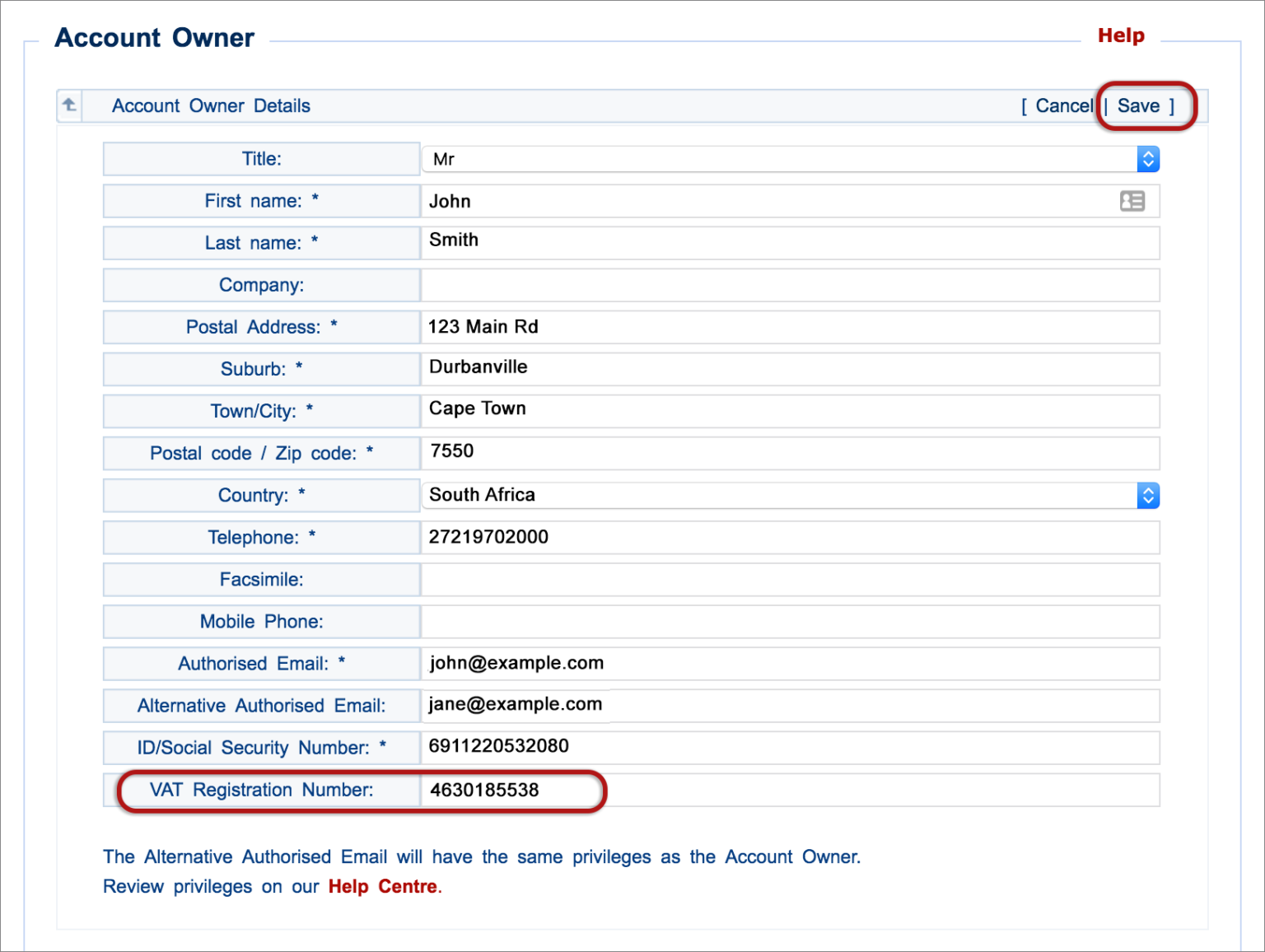

Update my VAT number xneelo Help Centre

Portuguese Vat Number Example Vat is paid by consumers when paying for goods or services. Vat is paid by consumers when paying for goods or services. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Portuguese vat number format individuals: For individuals, entities, vat, example: Supplies of services are subject to vat in portugal if provided to: The taxpayer individual number (”número de identificação fiscal” (nif)) is. Taxable persons that have their business, a fixed establishment,. Value added tax (vat) is a tax levied on sales or supplies of services in portugal.

From www.lisbob.net

How to get a Portuguese tax number NIF in person and online? Complete Portuguese Vat Number Example Vat is paid by consumers when paying for goods or services. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. For individuals, entities, vat, example: Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Supplies of services. Portuguese Vat Number Example.

From www.youtube.com

How to file online tax declaration Portugal YouTube Portuguese Vat Number Example For individuals, entities, vat, example: Portuguese vat number format individuals: The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Taxable persons that have their business, a fixed establishment,. The taxpayer individual number (”número de identificação fiscal” (nif)) is. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the. Portuguese Vat Number Example.

From trabalhador.pt

VAT Number Portugal descubra o que é e para que serve? Portuguese Vat Number Example The taxpayer individual number (”número de identificação fiscal” (nif)) is. For individuals, entities, vat, example: Value added tax (vat) is a tax levied on sales or supplies of services in portugal. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Portuguese vat number format individuals: The portugese fiscal identification. Portuguese Vat Number Example.

From snitechnology.net

Portugal makes ATCUD and QR codes obligatory invoice elements Portuguese Vat Number Example The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Supplies of services are subject to vat in portugal if provided to: Taxable persons that have their business, a fixed establishment,. Portuguese vat number format individuals: The taxpayer individual number (”número de identificação fiscal” (nif)) is. 28 rows use these eu country codes, vat numbers and. Portuguese Vat Number Example.

From www.portugal-accounting.com

What is the Portuguese taxpayer number NIF and what is it used for? Portuguese Vat Number Example The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Portuguese vat number format individuals: For individuals, entities, vat, example: Vat is paid by consumers when paying for goods or services. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). The taxpayer individual number (”número. Portuguese Vat Number Example.

From pergunta.pregunteme.com

Vat Number O Que é Portuguese Vat Number Example For individuals, entities, vat, example: The taxpayer individual number (”número de identificação fiscal” (nif)) is. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Supplies of services are subject to vat in portugal if provided to: Vat is paid by consumers when paying for goods or services. 31 rows. Portuguese Vat Number Example.

From www.youtube.com

IVA (VAT) IN PORTUGAL YouTube Portuguese Vat Number Example Portuguese vat number format individuals: Vat is paid by consumers when paying for goods or services. Supplies of services are subject to vat in portugal if provided to: 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Value added tax (vat) is a tax levied on sales or supplies. Portuguese Vat Number Example.

From www.lawyers-portugal.com

VAT in Portugal Portuguese Vat Number Example 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Value. Portuguese Vat Number Example.

From www.lawyers-portugal.com

VAT Registration in Portugal Updated for 2024 Portuguese Vat Number Example The taxpayer individual number (”número de identificação fiscal” (nif)) is. Taxable persons that have their business, a fixed establishment,. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Supplies of services are subject to vat in portugal if provided to: For individuals, entities, vat, example: Vat is paid by consumers when paying for. Portuguese Vat Number Example.

From www.lisbob.net

How to get a Portuguese tax number NIF online? Complete guide to Portuguese Vat Number Example 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Portuguese vat number format individuals: Supplies of services are subject to vat in portugal if provided to: The taxpayer individual number (”número de identificação fiscal” (nif)) is. Vat is paid by consumers when paying for goods or services. Value added. Portuguese Vat Number Example.

From research.pej.pt

A lower VAT rate on electricity in Portugal Portuguese Economy Portuguese Vat Number Example The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Portuguese vat number format individuals: For individuals, entities, vat, example: Taxable persons that have their business, a fixed establishment,. Vat is paid by consumers when paying. Portuguese Vat Number Example.

From www.easytax.co

VAT in Portugal the guide to VAT Easytax Portuguese Vat Number Example Vat is paid by consumers when paying for goods or services. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Portuguese vat number format individuals: Value added tax (vat) is a tax levied on sales or supplies of services in portugal. The taxpayer individual. Portuguese Vat Number Example.

From immigrantinvest.com

NIF in Portugal How to Get an Individual Tax Number Portuguese Vat Number Example For individuals, entities, vat, example: Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Portuguese vat number format individuals: The taxpayer individual number (”número de identificação fiscal” (nif)) is. Vat is paid by consumers when paying for goods or services. 28 rows use these eu country codes, vat numbers and foreign language letters. Portuguese Vat Number Example.

From www.template.net

Invoice Template with Value Added Tax 15+ Free Word, Excel, PDF Portuguese Vat Number Example Portuguese vat number format individuals: The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. The taxpayer individual number (”número de identificação fiscal” (nif)) is. For individuals, entities, vat, example: Vat is paid by consumers when paying for goods or services. Taxable persons that have their business, a fixed establishment,. 28 rows use these eu country. Portuguese Vat Number Example.

From www.sufio.com

Portuguese invoices for Shopify stores Sufio Portuguese Vat Number Example 28 rows use these eu country codes, vat numbers and foreign language letters to complete an ec sales list (esl). Taxable persons that have their business, a fixed establishment,. Vat is paid by consumers when paying for goods or services. 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if. Portuguese Vat Number Example.

From www.fonoa.com

Fonoa EU VAT Number Formats Portuguese Vat Number Example The portugese fiscal identification number (nif) is 9 digits in the format nnn nnn. Vat is paid by consumers when paying for goods or services. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Supplies of services are subject to vat in portugal if provided to: The taxpayer individual number (”número de identificação. Portuguese Vat Number Example.

From www.asesoriaorihuelacosta.com

Entender qué es un vat number (Impuesto sobre el Valor Añadido) Portuguese Vat Number Example Portuguese vat number format individuals: 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Value added tax (vat) is a tax levied on sales or supplies of services in portugal. Supplies of services are subject to vat in portugal if provided to: The taxpayer. Portuguese Vat Number Example.

From www.tide.co

VAT invoice requirements Tide Business Portuguese Vat Number Example Portuguese vat number format individuals: For individuals, entities, vat, example: 31 rows the relevant nation’s country code — consisting of two letters — is inserted before the vat number if the company is using the. Supplies of services are subject to vat in portugal if provided to: Vat is paid by consumers when paying for goods or services. The portugese. Portuguese Vat Number Example.